Taking Stock

Welcome

Regional outlook

Real estate capital markets remained subdued in the first quarter of 2024. Investment turnover across all sectors fell by 18% on the year, registering the lowest quarterly outturn in over a decade. The economic environment, meanwhile, remains broadly unchanged. Growth has now likely bottomed out, with high frequency data showing some growing momentum at the beginning of this year, while risks to the outlook are evenly balanced.

Yet ‘sticky’ inflation, particularly in the fiscally-charged US economy, is delaying expectations for a policy pivot from the major global central banks. This is feeding into investor behaviour; occupational markets, particularly in the office sector, broadly mirror the fortunes of the wider economy. But capital markets have detached from this reality, and investors are struggling to agree on what constitutes value in a high interest rate environment.

Oliver Salmon

Director, World Research�Global Capital Markets

Rasheed Hassan

Head of Global Cross Border Investment�Global Capital Markets

Market view

Global outlook

We hope you enjoy our latest review of global real estate capital markets.

EXPLORE THE REPORT

Global outlook

Regional outlook

Market view

GLOBAL OUTLOOK

Savills 2024

Back to the top

A review of global real estate capital markets, Q1 2024

view the webinar

view the webinar

download the full report

download the full report

Our latest review of global real estate capital markets explores the appetite for deal-making across EMEA, North America, and APAC.

Welcome

Savills 2024

Back to the top

next page

Market view

Regional outlook

Global outlook

Welcome

Annual Review

Offices

Logistics

Annual Review

Offices

Logistics

Global outlook

regional OUTLOOK

Savills 2024

Back to the top

Head of EMEA Industrial and Logistics

Marcus de Minckwitz

The European logistics market is entering not just a new chapter, but something more akin to an entire new book in a series. Logistics 2.0.

Global logistics investment declined by nearly 16% in Q1.

US$36.5bn

Markets expect just one rate cut from the US Fed this year.

1

Logistics share of global investment in Q1, rising above the office (23.5%) and multifamily (19.9%) sectors.

23.7%

The IMF forecasts global economic growth to continue at the same pace as last year.

3.2%

The global economy remains resilient, with PMI data providing evidence of a momentum shift in the first quarter, suggesting the economy has now bottomed out. But there is little expectation of a rapid about-turn; 2024 is likely to remain subdued, although slowing inflation and falling interest rates will provide some impetus as we move through the year.

�The US economy remains the exception to the rule, roaring ahead of its peers. Some attribute this to ‘American exceptionalism,’ while others point to the large fiscal deficit. There is some truth to both arguments. But strong demand is prompting concerns over inflation, which has come in stronger than anticipated in recent months.

�This has underpinned a sharp reversal in rate expectations; markets are now pricing just one rate cut in 2024 from the Fed, down from more than six at the beginning of the year. US Treasury yields have pushed above 4.5% again, putting the brakes on the AI-fuelled bull market run, and supporting a general strengthening in the US dollar.

A resilient yet subdued economy

In Europe, the economic outlook is more receptive to rate cuts, as stagnant growth provides little risk of a demand-driven inflation rebound. The German economy in particular is struggling to find a spark, still reeling from the energy price shock, and a slowdown in global trade. Policymakers at both the ECB and Bank of England are signalling a June pivot in policy rates, with 75-100bps in rate cuts expected through the second half of this year.

�Inflation remains a relatively positive phenomenon in Japan, where the Bank of Japan ended its long experiment of negative interest rates in March. Chinese growth surprised on upside in Q1 2024, supported by the manufacturing sector. However, Chinese domestic demand remains weak, prompting growing concerns over where that output is being sold (even though China is effectively exporting deflation). Given it is an election year in US, tensions will rumble throughout 2024, which combined with the ongoing conflicts in Ukraine and the Middle East, will keep geopolitical events in the headlines, and on investors' minds.

Global logistics investment turnover

Global investment in the logistics sector fell by nearly 16% y/y to US$36.5bn, representing the weakest quarterly outturn since the Covid-19 pandemic. However, while liquidity for large lot sizes in the office sector has largely dried up through this cycle, logistics remains the only sector with scale, particularly outside US multifamily. As such, large portfolio and M&A activity can distort the data, and much of the y/y decline this quarter can be attributed to the US$4.4bn takeover of Summit REIT in Canada by a joint-venture led by GIC, which completed in early 2023.

�Nevertheless, investment activity is heading in the wrong direction, as evidenced by the 4-quarter moving average (4QMA), which is trending at 2016 levels. Throughout this cycle, investors have continued to report a strong preference for logistics – evidenced by a shift in target allocations – underpinned by strong conviction in the fundamental drivers of growth. Yet the cyclical dynamics still warrant some caution in the short term. Leasing activity in the US, for example, fell to the lowest level in more than a decade this quarter, while vacancy is rising in most markets.

Some mean reversion in rents is expected as we move through the year, making the underwrite on logistics more challenging. In Europe, prime market rents have continued to

post double-digit gains in the last 12 months, despite a 150-200bps rise in the regional average vacancy rate. However, the historical relationship between the two is expected to recouple, bringing rental growth down this year. In other regions, this trend is already evident in the data.

�Rising vacancy and a more cautious investor base is also driving some bifurcation in the market. This is evident in Europe, where the definition of prime has narrowed significantly in recent years. But other markets are also seeing some divergence in rents and values, particularly where new supply is a key driver of vacancy, such as in Japan, where the vacancy rate in the Greater Tokyo area has risen from nearly zero to 7.1% in Q1 2024.

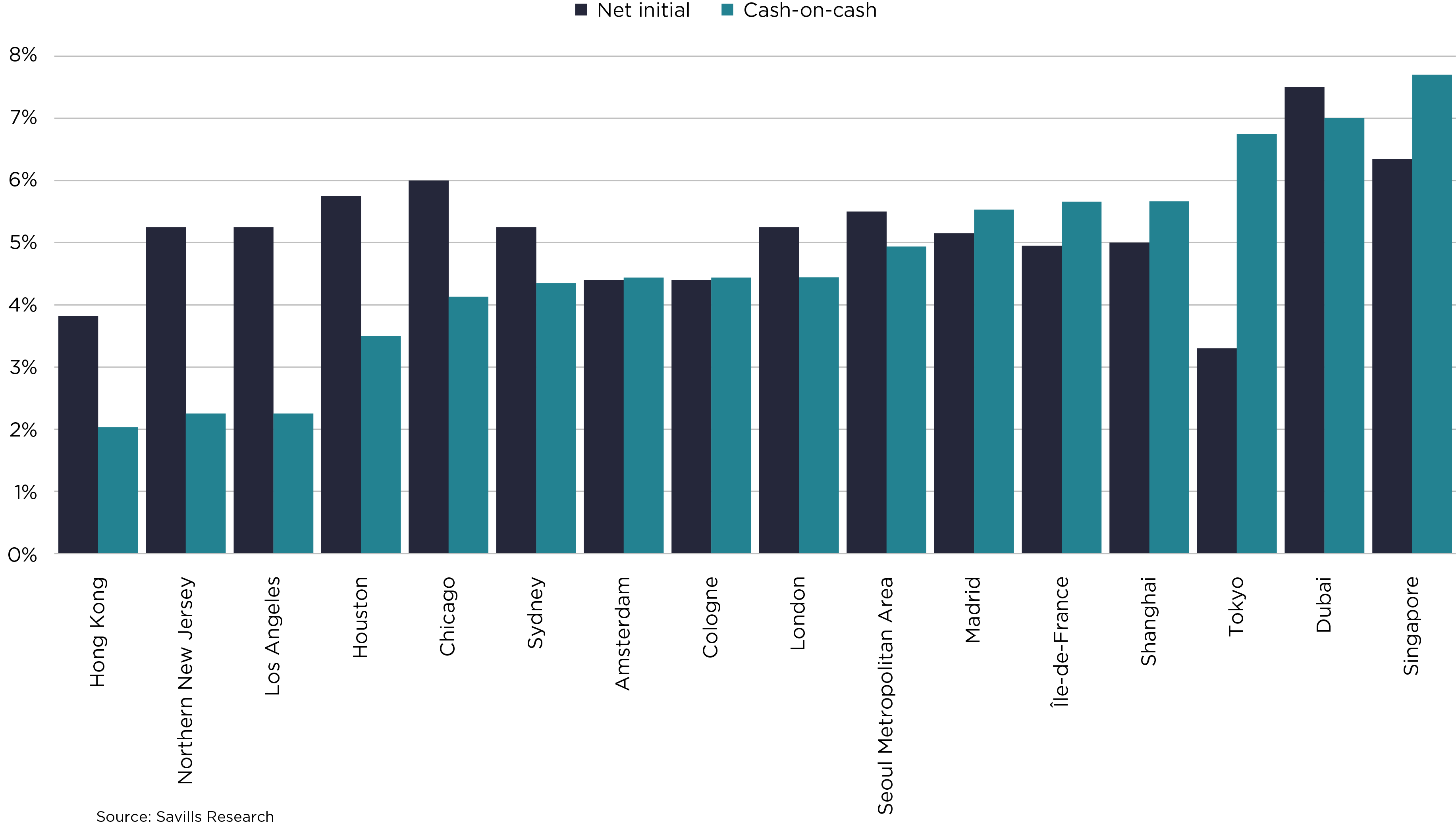

�Resilient demand at the top end of the market should support more stability in pricing. Some further upward pressure is still evident on prime yields in Northeast Asia; in China, due to the weak occupational outlook and significant excess supply, as well as in Hong Kong and South Korea. But the correction has largely run its course in Europe and North America, with some markets such as London and Madrid looking well set for some yield compression as interest rates come down over the next 12 months.

Cyclical dynamics beget cautious investors

Prime logistics yields, Q1 2024

Houston 5.75%

Los Angeles 5.25%

Sydney 5.25%

Chicago 6.00%

Shanghai 5.00%

Hong Kong 3.82%

Tokyo 3.30%

Singapore 6.35%

Seoul Metropolitan Area 5.50%

Northern New Jersey 5.25%

Île-de-France 4.95%

Amsterdam 4.40%

Cologne 4.40%

Madrid 5.15%

London 5.25%

Dubai 7.50%

Houston

Sydney

Shanghai

Amsterdam

Cologne

Tokyo

Hong Kong

Singapore

Los Angeles

Chicago

Île-de-France

London

Madrid

Dubai

Northern New Jersey

Seoul Metropolitan Area

Houston 60%

Sydney 50%

Shanghai 40%

Amsterdam 55%

Cologne 55%

Tokyo 60%

Hong Kong 40%

Singapore 50%

Los Angeles 60%

Chicago 60%

Île-de-France 55%

London 55%

Madrid 50%

Dubai 50%

Northern New Jersey 60%

Seoul Metropolitan Area 60%

Houston 7.25%

Sydney 6.15%

Shanghai 4.00%

Amsterdam 4.37%

Cologne 4.37%

Tokyo 1.00%

Hong Kong 6.50%

Singapore 5.00%

Los Angeles 7.25%

Chicago 7.25%

Île-de-France 4.37%

London 5.91%

Madrid 4.77%

Dubai 8.00%

Northern New Jersey 7.25%

Seoul Metropolitan Area 5.88%

Houston 3.50%

Sydney 4.35%

Shanghai 5.67%

Amsterdam 4.44%

Cologne 4.44%

Tokyo 6.75%

Hong Kong 2.03%

Singapore 7.70%

Los Angeles 2.25%

Chicago 4.13%

Île-de-France 5.66%

London 4.44%

Madrid 5.53%

Dubai 7.00%

Northern New Jersey 2.25%

Seoul Metropolitan Area 4.94%

Houston 1.55%

Sydney 1.28%

Shanghai 2.71%

Amsterdam 1.81%

Cologne 2.11%

Tokyo 2.57%

Hong Kong 0.11%

Singapore 3.24%

Los Angeles 1.05%

Chicago 1.80%

Île-de-France 2.13%

London 1.33%

Madrid 2.00%

Dubai 3.30%

Northern New Jersey 1.05%

Seoul Metropolitan Area 2.09%

Prime yield

Outlook for yields, next 12 months

Typical LTV

All-in cost of debt

Cash-on-cash yield

Risk premium (over gov bonds)

Prime yield

Outlook for yields, next 12 months

Typical LTV

All-in cost of debt

Cash-on-cash yield

Risk premium (over gov bonds)

Source: Savills Research and Macrobond Note: Yields may be different to quoted values in markets where the convention is to use a gross rather than net value. Values based on end-of-quarter data. Yields in Singapore reflect the domestic land tenure system, where the longest lease for new industrial properties is 30 years.

Net initial yields are estimated by local Savills experts to represent the achievable yield, including transaction and non-recoverable costs, on a hypothetical grade A big-box logistics facility located in a prime location, fully let to a single good profile tenant on a 10-15 year open market lease. The typical LTV and cost of debt represent the anticipated competitive lending terms available in each market. Cash-on-cash returns illustrate the initial yield on equity, assuming the aforementioned LTV and debt costs. The risk premium is calculated by subtracting the end-of-period domestic ten-year government bond yield (as a proxy for the relevant risk free rate of return) from the net initial yield. Data is end-of-quarter values.

(as at end-March)

Methodology

Key transactions

City: Los Angeles

�Building: Blackstone Southern California Industrial Portfolio

�Tenant: Multiple

�Lease Length (WAULT): Undisclosed

�Area: 3.0mn sqft

�Price/NIY: US$1.0bn / 4.7%

�Vendor: Blackstone�

Market view

Regional outlook

Global outlook

Welcome

Vendor Nationality: US

�Purchaser: Rexford Industrial REIT

�Purchaser Nationality: US

�Comments: The deal represents one of the largest in Southern California over the last 12 months, consisting of a portfolio of 48 properties and over 3mn sqft of logistics space, located in Los Angeles and Orange Country. The properties are 98% occupied, and according to Rexford, are anticipated to realise a stabilised cash yield of 5.6%.�

City: Belgium and Netherlands

�Building: Intervest Office & Warehouse portfolio

�Tenant: Multiple

�Lease Length (WAULT): 5 years

�Area: Undisclosed

�Price/NIY: US$1.2bn (€1.3bn) / N/A

�Vendor: Intervest Offices & Warehouses�

Vendor Nationality: Belgium

�Purchaser: TPG

�Purchaser Nationality: US

�Comments: TPG agreed to take private the listed REIT Intervest Offices & Warehouses, valuing the company at €1.3bn. Reports suggest that they plan to dispose of all office assets, valued at around €300mn, focusing instead of expanding the logistics platform.�

welcome

download the full report

download the full report

GLOBAL OUTLOOK

next page

Savills 2024

Back to the top

previous page

Market view

Regional outlook

Global outlook

Welcome

Annual Review

Offices

Logistics

Annual Review

Offices

Logistics

Regional outlook

Director, World Research

Oliver Salmon

The outlook for rental growth continues to support the underwrite for new deals in the region… but uncertainty over what core represents in a rapidly bifurcating market is nevertheless restricting activity levels.

Total investment of nearly US$8.3bn across Europe represented a small increase on Q1 2023. This was however propped up by a single large entity-level deal, with the US private equity group TPG acquiring the listed firm Intervest Offices & Warehouses – and their sprawling logistics portfolio located across Belgium and the Netherlands – for a reported €1.3bn (US$1.2bn). Excluding this deal, the first quarter would have been the weakest start to a year in over a decade.

�The traditional big three markets continued to underperform in the first quarter, as they did in 2023; investment in the UK, France, and Germany was between 10-15% down on the year (in local currency terms). This largely mirrors the occupational market, where the smaller peripheral markets are on the whole showing more resilience though this current cycle.

�Strong rental growth has continued to support the underwrite for new deals in the region, without necessarily requiring lower interest rates, as evidenced by the large share of portfolio deals completing this quarter. However, a mean reversion in rents is expected; rental growth has recently detached from its long-term relationship with vacancy rates, but this is unlikely to be sustained, leading to a more challenging environment for dealmaking. �

Uncertainty over what core represents in a rapidly bifurcating market (albeit less talked about compared with offices) is also restricting activity levels; the majority of buyers will be running a manage-to-core strategy, so without good visibility on what the exit looks like, it remains difficult to transact. Emerging sub-sectors, meanwhile, are quickly becoming crowded, such as data centres and self-storage.

�Providing there is little deviation in the outlook for interest rates, the pricing correction from a yield perspective is now likely done across much of Europe. Indeed, we expect some compression to come though over the next 12 months in Madrid and London. In both cases, benchmark prime yields peaked above 5% in this cycle, providing a relatively better initial return compared with peer markets.

�The Netherlands, too, may also see the prime yield fall from the current level of 4.4%. Investor interest will be sustained by the tight occupational market, which has fuelled strong rental growth in recent years. The German market, by contrast, is the most likely to see further value degradation. A smaller domestic investor base implies less resilience in capital markets activity, while the outlook for the energy-intensive export-orientated economy remains subdued.

APAC

North America

EMEA

APAC

North America

EMEA

Average prime rental growth and vacancy in Europe

Director, World Research

Oliver Salmon

There is significant conviction in the fundamentals supporting the logistics sector, and investors remain willing to deploy at scale when the opportunity arises.

Market rents in Los Angeles have fallen by 9% over the last 12 months.

-9.0%

Falling construction starts nationwide should keep rising vacancy in check.

-70%

US investment in the first quarter of 2024 was 21% down on the year.

US$16.6bn

US rental growth and vacancy risk

Director, World Research

Oliver Salmon

The absence of a strong motivation to sell in Australia is extending a period of price discovery.

prime logistics yields, Q1 2024

US logistics investment of US$16.6bn in Q1 2024 was 21% down on the year, and the weakest quarter since Q2 2020. Nevertheless, there is significant conviction in the fundamentals supporting the sector, and investors remain willing to deploy at scale when the opportunity arises, as evidenced by the US$1bn acquisition of a portfolio of 48 properties in Southern California by Rexford Industrial from Blackstone.

�Wider investor caution is supported however by a softening occupational backdrop, where new supply and moderating demand is pushing vacancy higher and weighing on rental growth. The national vacancy rate rose to 6.7% in Q1, up 240bps on the year prior, with take up of 155mn sqft representing the weakest quarter in more than a decade. The Los Angeles market – often a first mover given its exposure to a major international port and consumer-centric economy – has now experienced six consecutive quarters of negative net absorption. Other major markets, such as Northern New Jersey and Inland Empire, also experienced falling net absorption at the beginning of this year. This trend is compounded by record levels of available sublease space as tenants right-size their operations.

This is feeding into the outlook for income growth, which may make investors second guess their assumptions when underwriting new deals. In Los Angeles, for example, market rents are nearly 9% down on the year. This remains the exception to the rule, with the majority of markets still seeing solid growth on the year. However, sequential change is moderating, and landlords are having to work harder to fill empty space.

�At the national level, average rents are expected to stabilise through the year. A near 70% decline in construction starts nationwide will provide a backstop and limit any further deterioration in vacancy, while occupational demand should recover through the year. But markets that have seen the most significant boom cycle since Covid-19, such as Los Angeles and the wider Inland Empire, as well as Dallas-Fort Worth and Atlanta, are at risk of a short-term correction.

�Nevertheless, there is little distress in the market, with significant additional equity in loan collateral owing to strong market rental growth in recent years. Tailwinds continue to support sector fundamentals. Our prime yields remain unchanged this quarter, ranging from 5.25% in Northern New Jersey and Los Angeles, to 6% in Chicago.

Investment turnover across the APAC region rose to US$9.4bn in Q1 2024, up 27% on the year. Growth would be higher if excluding currency effects, with the USD gaining around 12% in value against the Japanese yen, and 4-5% against other major regional currencies, since Q1 2023.

�Regional growth was underpinned by a notable pick-up in activity in China and Japan, up by 60% and 91%, respectively (in local currency terms). The former was however flattered by the transfer of a large logistics portfolio by GLP Capital Partners into their recently launched China income fund. Excluding this deal, investment would have fallen, an outcome that would be more in keeping with the occupational backdrop, which provides little upside to the limited investor base; net demand remains lacklustre and unable to absorb new supply, with vacancy in Shanghai rising to 19.2% this quarter, up 830bps in the last 12 months.

�The strength in the Japanese market better reflects local dynamics, however here too the onboarding of new supply over the last few years is providing a challenge to investors, with the vacancy rate in the Greater Tokyo area rising to 7.1%, up from near zero in late 2020. Increased bifurcation between prime and secondary facilities is expected to grow as new supply increases competition, with rental growth limited to the top end of the market.

Behind China and Japan, investment activity in Australia and South Korea was broadly unchanged on the year. In Australia, the absence of a strong motivation to sell is extending a period of price discovery; the stable yield profile is as much a function of limited transactional evidence than anything else. But several notable greenfield development sales in Q1 suggest the industrial market remains resilient. A diversifying buyer pool and continued rental growth should support a pick-up in activity as interest rate cuts feed into the system later in the year.

�In South Korea, the absence of foreign capital is holding back transactional activity in early 2024. The prime yield for the Seoul Metropolitan Area held steady at 5.5%, but is still expected to move out over the next 12 months. Excess supply is leading to vacancy risk, following a 25% increase in stock in 2023. This is particularly evident in cold storage, where investors are also concerned that leasing demand may have also peaked. Growing landlord concessions are weighing on net effective rents as a consequence, and it will take time for demand to absorb the excess supply, despite a rapidly shrinking development pipeline.

(as at end-March)

Market view

Regional outlook

Global outlook

Welcome

market view

Global outlook

Savills 2024

Back to the top

Average rental growth in 2023, nearly double what would be anticipated given the vacancy rate.

11%

The prime yield in London, which is expected to come in over the next 12 months.

5.25%

European investment was broadly unchanged in comparison with Q1 2023.

US$8.3bn

The prime yield in Tokyo is expected to remain steady over the next 12 months, although new supply is driving a bifurcation in the market.

3.3%

Greenfield investment in Australia, highlighting continued resilience in logistics demand, despite weakness in the wider transactional market.

$1.58bn

Vacancy in Shanghai, as net demand fails to keep pace with new supply onboarding.

19.2%

download the full report

download the full report

GLOBAL OUTLOOK

next page

previous page

Savills 2024

Back to the top

Market view

Regional outlook

Global outlook

Welcome

Director, World Research

Annual Review

Offices

Logistics

Annual Review

Offices

Logistics

Market view

Market view

Regional outlook

Global outlook

Welcome

regional outlook

Savills 2024

Back to the top

Head of EMEA Industrial and Logistics

Marcus de Minckwitz

Marcus de Minckwitz shares his view on the market

The European logistics market is entering not just a new chapter, but something more akin to an entire new book in a series. Logistics 2.0.

�The first book ended in the aftermath of the pandemic with the inflationary crisis, rate hikes and the invasion of Ukraine. The rapid growth of the market had been brought to an abrupt halt and uncertainty in the markets reached levels not seen since the GFC.

�Encouragingly though, the data is allowing the author to settle reader’s nerves. Take-up has normalised to pre-pandemic levels and shows improvement year-on-year; supply remains constrained, and this will see vacancy rates start to fall back in the second half of the year; rents have continued to grow, yields have stabilised and demand improved.

�Yet it is a far more complex landscape in front of us. Occupational markets are showing bifurcation between new and older stock, whilst occupiers themselves are having to battle short term economic challenges with the

need to invest in their supply chains to enable medium to long term growth and drive efficiencies. The capital markets are as competitive and dynamic as they have been for two years, but still suffer from an absence of core buyers. They are beginning to re-emerge though.

Sub-sectors have gone from footnotes to having whole chapters written on them. Data Centres have the hallmarks of the logistics markets in 2012, Industrial Outdoor Storage (IOS) is now an established market in the UK, and the journey is beginning on the continent. and we are seeing disruption in self-storage and cold storage for new entrants backed by private equity.

�The role the sector has to play in the energy transition is arguably the most interesting and the cover to Logistics 2.0 would undoubtedly be green. ESG is essential to any business plan; but not just to reach a certain accreditation or rating, instead for logistics to make very meaningful contribution that in turn leads to value creation. We are quickly moving a far distance away from sheds just being a slab, four walls and a roof.

download the full report

download the full report

GLOBAL OUTLOOK

previous page

Savills 2024

Back to the top

Market view

Regional outlook

Global outlook

Welcome

Annual Review

Offices

Logistics

Annual Review

Offices

Logistics